Bach Hoa Hang Nga: Your Trusted Source for Quality Products

Explore a wide range of quality products and insightful articles.

Buckle Up: Why Crypto Volatility is the Thrill Ride of Investing

Experience the wild world of crypto! Discover why its volatility makes investing an exhilarating thrill ride you can't afford to miss!

Understanding the Rollercoaster: The Factors Driving Crypto Volatility

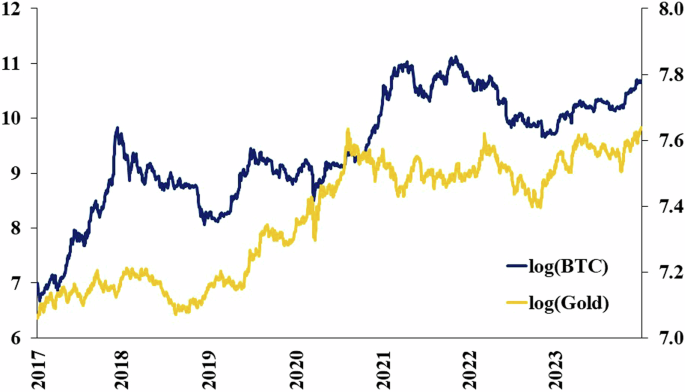

Cryptocurrency has garnered a reputation for its extreme price fluctuations, often resembling a rollercoaster ride. Several factors contribute to this volatility. Firstly, the market is heavily influenced by speculation, as investors react to news, trends, and social media discussions. For instance, announcements from major companies about adopting cryptocurrency can trigger rapid price surges, while regulatory news often leads to sharp declines. Additionally, the relatively low market capitalization of many cryptocurrencies means that even modest transactions can lead to substantial price swings.

Another critical factor driving crypto volatility is the lack of regulatory frameworks. Unlike traditional financial markets, which are subject to stringent regulations, the cryptocurrency market remains largely unregulated, allowing for greater manipulation. Furthermore, the availability of leverage in trading amplifies price changes, as traders increase their bets without fully understanding the risks involved. This combination of speculation, low market capitalization, and minimal regulation creates a perfect storm for volatility, leaving investors on a thrilling but unpredictable financial journey.

Counter-Strike is a multiplayer first-person shooter game that has gained immense popularity since its release. Players can choose to be part of either the terrorist or counter-terrorist team, engaging in tactical combat and strategy. For those looking to enhance their gaming experience, using a cloudbet promo code can provide exciting bonuses and offers.

Is Crypto Volatility a Risk or an Opportunity for Investors?

The volatility of cryptocurrencies is often seen as a double-edged sword. On one hand, the wild price fluctuations can pose a significant risk for investors who are unprepared for sudden market changes. For example, a rapid drop in the price of Bitcoin or Ethereum can lead to substantial losses for those who have not implemented proper risk management strategies. This unpredictability might deter conservative investors who prefer stable asset classes, thereby classifying crypto volatility as a genuine risk.

On the other hand, savvy investors view this crypto volatility as an exciting opportunity for profit. The same price swings that can cause losses can also result in substantial gains for those who are willing to engage in active trading or invest strategically. For instance, an investor who correctly anticipates a rebound may reap significant rewards. Therefore, understanding how to leverage the situations presented by market fluctuations allows investors to capitalize on the unpredictable nature of cryptocurrencies, transforming what some see as a risk into a profitable opportunity.

How to Navigate the Ups and Downs of Cryptocurrency Investment

Investing in cryptocurrency can be a rollercoaster ride filled with exhilarating highs and daunting lows. To successfully navigate this volatile landscape, investors should first educate themselves about the fundamentals of blockchain technology and the various factors influencing market trends. Creating a comprehensive investment strategy tailored to your risk tolerance is essential. Consider diversifying your portfolio to mitigate potential losses. Key steps include:

- Researching different cryptocurrencies

- Setting clear investment goals

- Tracking market movements and news

As the cryptocurrency market evolves, emotional resilience is crucial for managing the ups and downs of your investments. It’s easy to get swept up in the fear of missing out (FOMO) during a market surge or panic during a downturn. To maintain a level head, employ techniques such as:

- Emotional discipline: Stick to your plan.

- Regular reviews: Assess your investment strategy periodically.

- Community engagement: Join forums or social media groups to get support and insights.

By following these guidelines, you can effectively navigate the unpredictable world of cryptocurrency investment.